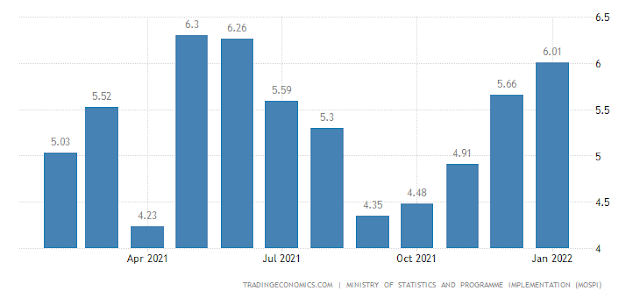

Impact of Rate Hikes in the Real Economy

Impact of Rate Hikes in the Real Economy It is noteworthy that the rate of Inflation is increasing around the world after Covid-19 Pandemic. To control this inflation rate, most of the Developed and Emerging economy nations are increasing the Bank Interest rate. Let's see how the rising interest rates will play in the economy of Developed and Emerging economies and it's impact in the Equity(Stock) Market. Generally, the Higher interest rate pegs High cost of borrowing for the Investors and Customers. It also increase the cost of borrowing for consumption. It leads to the Reduction of Spending. On the business side, the higher interest rate affects the future revenue growth of the respective companies. So, finally it would impact the Stock price of a listed companies. On the other side, if there is a falling interest rate - an individual consumer gets loan at a cheaper interest rate. It also encourages the Spending that what we have seen in the Uncertainty times in the Real eco...