India's Retail Inflation revised to 5.84 Percent in March 2020

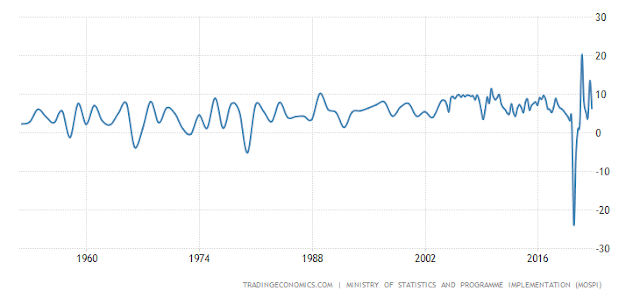

India's Retail Inflation revised to 5.84 Percent in March 2020 Inflation in India can be calculated in Two ways - Consumer Price Index (Retail) and Whole sale price Index. The CPI Retail inflation was said to be as revised to 5.84 Percent for the month of March 2020. It is noteworthy that the inflation in January 2020, was 7.59 Percent. Now, it seems declined, but it it more than Central Bank's expectation. we have to analyze the numbers during Lock down and Post Lock down session. The Central Statistics office has so far taken more data related on prices from the Rural and Urban areas. Since 19th March, 2020 it was suspended due to Covid-19 Lock down. The Inflation for the month of April 2020 has not been released. Instead, the March inflation was revised there. PM's recent speech hinted that there could be a fourth Lock down (Lock down 4.0), while the businesses may run with some restrictions. Prime Minister were also said about there is a stimulus to boost the current ec...