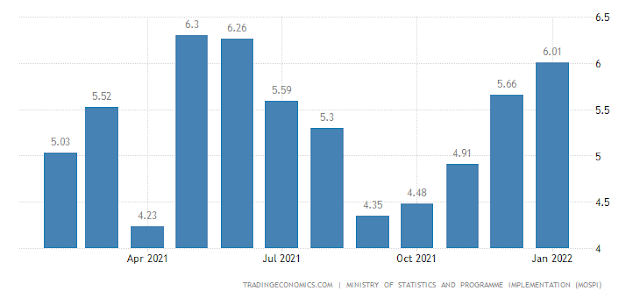

India's CPI Retail Inflation to 6.01 Percent in January 2022

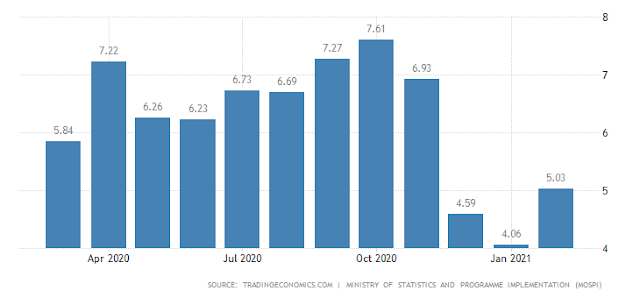

India's CPI Retail Inflation to 6.01 Percent in January 2022 CPI(Consumer Price Index) Inflation, also known as Retail Inflation rose to 6.01 Percent in the month of January 2022. It is noteworthy that the Retail inflation rate has been volatile in the recent few months post Covid-2019. At the same time, India's Unemployment rate has dropped slightly. The Unemployment rate for the month of January was around 6.57 Percent - Urban contributed with 8.16 Percent and 5.84 Percent in Rural. For the past few months, the Unemployment rate in Urban areas has been higher than in Rural Areas. The current said CPI Retail inflation for the month of January is above the Central Bank's near term target. Due to the rising prices of Food inflation, it went above the 6 Percent rate. On January 2022, the pulses grew by 3 Percent, Vegetables by 5.19 Percent, Oil and Fats by 18.7 Percent. Retail Inflation of January 2022 is the highest price Since October 2020. Prices of Fuel and Light were a...