Portfolio Insurance - Why is it necessary ?

Portfolio Insurance - Why is it necessary ?

There is no such thing as a Risk-free investment today. Rather than avoiding the fact that there is risk in investing in general, one should know how to handle risk properly. Investment risk can be minimized through asset allocation and Diversification.

Decentralization is when you are in a position to invest (Say One Lakh rupees), without simply investing in the Bank Deposits or in the Equity Market as a whole, but in a combination of asset allocation like Deposits, Stocks, Gold and Bonds.

This way even if the Stock market goes down, your either investment instruments will provide the corresponding returns and give investment protection. At the same time while other investments are not able to reach the required returns that exceed inflation rate, Stock Market boom will increase your investment multiplier.

Usually when the interest rates are low in Banks, then the rates are slightly higher in Bonds. As the Stock Market declines as a Major crash, so does the return on Gold is better - Due to Hedging against inflation.

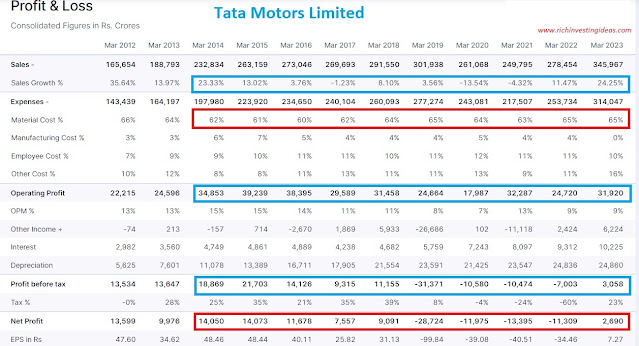

Investors in the stock market can reduce the sectoral risk when investing in various sectors rather than investing in a Single one. If we know the difference between Savings and Investing, we can create a good wealth in the long run.

While there is safety when it comes to Savings, Inflation is the only downside. But when it comes to investing, we have to deal with a variety of Risks in the real world. We need to make an investment backup to avoid unforeseen losses.

Investment backup is to help protect your daily financial life from the consequences of your investment. The investment you make may not give you any return or loss. At that time it is necessary to protect the situation that does not affect your Daily economic life. This is what we called as Investment Insurance or Investment Insulation.

When an individual becomes a Retail investor, it is necessary to obtain a Term Insurance Plan, Mediclaim, Accident Policy and an Emergency Fund. It is a good idea and make it as mandatory on the Investor Perspective. Debt Counseling, Periodic review on Investment are necessary to control the unexpected scenario.

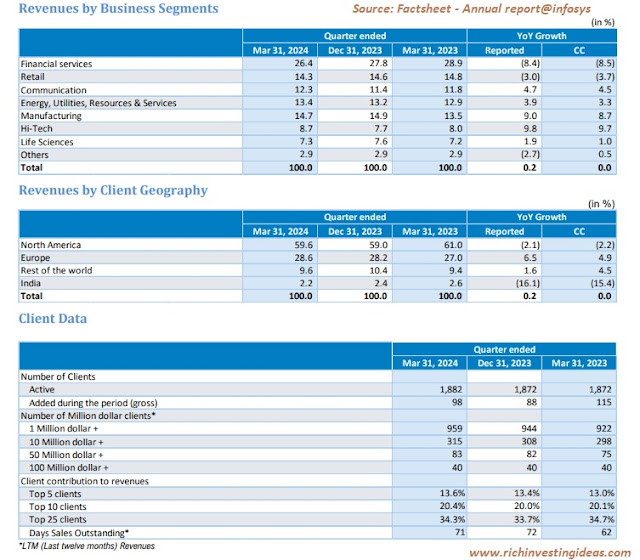

A Portfolio investment with a combination of Financial assets like Stocks, Bonds, Bank Deposits, Debt Mutual Funds, Gold ETF and in Cash. Few immovable assets like Real Estate Property and commodity is also consider with a Good Portfolio investment.

Kindly share your views / comments with a smile :)

Your blog is very valuable which you have shared here about financial advisor. I appreciate your efforts which you have put into this article and also it is a gainful article for us. Thank you for sharing this article here. Investing for Retirement in your 40's

ReplyDeleteYour information was so good. I learn more from this. I am sure you have great knowledge about this. Please share more information like this.

ReplyDeletefinancial management