Equity Investing Secrets - Lesson 1

Equity Investing Secrets - Lesson 1

Investing is an art for Wealth Creation. Although the Investing game with Equity varies in short to mid to Long term, and finally your long term friends succeeds. That's why i am happy to be a Long term Investor - Lot of Patience needs.

For most of the human, the desire to make money immediately, to become Quick Rich. But there is no such thing has yet been found. There is no such secret to become Rich, but it's Wealth Creation Forever. And that is the reason why the Richest people in the world are more interested to build the Wealth and Relationship in the long run.

The word, 'GROWTH' is defined to a Long term. We need time to grow our investments. If you are becoming a Millionaire in the next 5 years, then what next to do ? It's a $ Million question that you cannot quit your Career or Business after 5 years.

We need experience, We need the continuous growth, We need profits and we really need a Wealth forever. So, we are trying to learn and keep learning. Listening and Learning is the biggest secret to Create Wealth, obviously in Equities.

As a Doctor, an Engineer or any expert in any industry, we cannot evolve quickly. We keep learning and will evolve some day, but it would not be in a quick time. At the same time, we are greedy in the Stock Market. We are not ready to learn and take experience. We are thinking about converting a small bucks into Million Dollar in six months or a year, but not about the Wealth.

Learning is essential for the Stock Market. Even if you don't have a good Advisor or Mentor, you can read it through books and from google. Analyze the stocks, understanding about other Real Investment opportunities. No matter if you don't invest in stocks, continue to learn about the Stock Market for the next five years.

My Stock Investment Strategy:

- In the beginning period, a Novice Investor can invest a small amount in a selected stocks based on Value Investing - Fundamental Analysis. There is no matter about Little Money or Quantity in the Stock Market. Don't get too caught up in making a Quick Profit.

- While investing in any stock based on Fundamentals, buy a few quantity as a Trial Run. We can see whether the stock is fluctuating, even if it falls about 10-20 Percent, we can make the average on Share price.

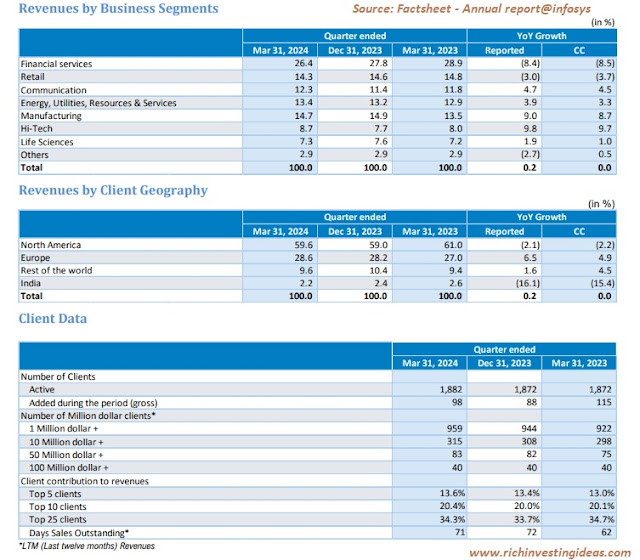

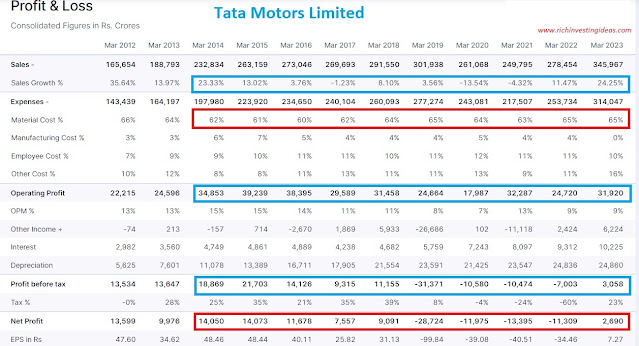

- Regularly track the Quarterly results of a stock, we bought. If there is any decline in Sales and Profit Growth, find out the reason. Ensure about the Dividend yield, Bonus or Buyback announcement of a Stock. So, it will give you the opportunity and idea to Wealth.

- If the price of a share you bought becomes Double on its price or investment, then sell half of the shares. With half of the shares sold, the invested amount has returned to you. You can use that profit for buying another stock or capital for any investments. If not finding anything, use it for your Learning Purpose.

- Keep the remaining shares for as long as the stock of a Company performs well. So, you are keeping the half for a Long to build Wealth.

- Get ready to sell a stock without waiting for the company to go bankrupt. So, keep track on Fundamental Numbers like Debt to Equity, Sales and Profit Growth, Cash Flow, Interest Coverage Ratio and others if required.

These are the above things that i have learned and experienced, Keep Learning also. Get used to it. Otherwise, you have to find an investment formula by Learning.

Let us listen to Wealth !

Kindly share your views / comments with a smile :)

www.richinvestingideas.com

Comments

Post a Comment