Macro Economic Policy - A brief explanation

Macro Economic Policy - A brief explanation

The Economic policy is the term supported to explain the Government's policy on Budget, Taxes, the supply of money, interest rates on monetary view, Employment status of a country. The Government's purpose is to stable the inflation and need for long term economic growth. As simple, how the country manages its income and expenditure.

The Economic policy Classified into two,

- Micro Economics

- Macro Economics

Micro Economics:

It tells the economics of an individual, group or a companies. The main intention for this policy, to analyse the demand and supply for the production of an individual or a business level.

Macro Economics:

It describes the economic policy of whole or all like Gross Domestic Product (GDP), Industrial production, Inflation, Current Deficit, Employment or unemployment statistics, the import and export data.

The Macro Economic Policy:

As we know that the micro economics describe about the individual level. But, the Macro economic policy is the lead for a country globally. Individual can expected on his daily wages, opportunity cost, needs and wants. On this regard, the individual's expectation always linked with the Macro economic policy. However, the individual's financial life mostly depending upon the Macro Economic changes.

The Government Policy changes may affect the individual with the Inflation, Taxes, GDP, unemployment basis. Let's we see some of the common factors influenced in the Macro economic levels.

Gross Domestic Product (GDP):

The Gross Domestic product is the final value of all goods and services produced by a particular country in a certain period of time. The GDP growth is also a primary measurement of the Macro Economy.

For an instance, If a country's goods and services production have a worth of 1000 Billion currency in a particular year and its grown to 1100 Billion in the next year. Then, it had a growth of 10 % on its economy. The GDP commonly calculated on the product of price and the quantity of goods and services produced is given with the reference to a base year. For an instance, the base year is 2000 and the base index value is set at 100.

How the GDP measured,

The GDP calculation is based on goods and services by the market prices, but not as cost. The Intermediate uses are not counted for the products and services. It includes the intermediate values on the value of the final product. The GDP refers to the output produced in the country. It also defines as a real rate, but not included the impact of inflation.

In India, the GDP is calculated in two different methods. One is based on economic activity, which is factor cost and the another method is based on expenditure, which is at market prices. There are different sectors are considered for this calculation like Agriculture, Manufacturing, Mining, Electricity and gas, Construction, Transport and communication, Real Estate and Business, Social and personal.

A Simple GDP Calculation will,

GDP = Private consumption(C) + Gross investment(I) + Government investment(G) + Government spending(G) + (Exports – Imports).

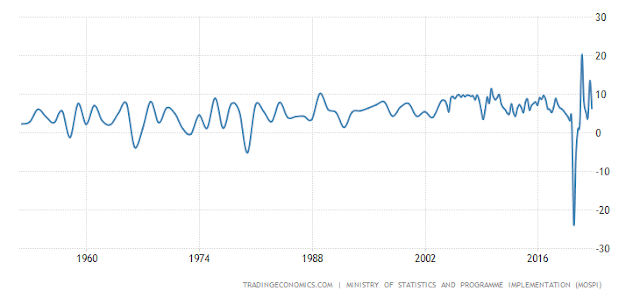

India - GDP growth rate (Historical):

Index of Industrial Production (IIP):

The IIP is based on the estimation of the Industrial performance. IIP measures changes in the industrial activity with reference to a base year (Previously 2004-05, Revised to FY 2017-18). IIP measures the growth in 22 industry groups classified as Industrial sectors and used based sectors. Like wise, Industry sectors are Manufacturing, Mining, Electricity and the used based sectors are capital goods, consumer goods, basic goods.

Index of Industrial production (IIP) is a monthly index, which volatile on seasonality basis than GDP. It also a lead indicator of the corporate earnings. The Central Statistical Organisation (CSO) publishes the periodic data of an IIP. It is commonly calculated by the weighted average of production related to all industrial activities. The Reserve Bank of India (RBI) also focuses on the IIP value to frame its monetary policy.

The IIP fall denotes the weak on the result of Industrial production. It impacts directly in the stock market, because of the companies earnings may low on sales and profits. But, it would also help to find the undervalued stocks, which are fundamentally strong. The higher of IIP also helps the banking sectors on its borrowing and lending. However the banking sector is not considered as Industry sector to calculate IIP. For instance, if a company's sales and profits are good, then the value of IIP will increase.

Inflation:

It is the rate at which the general level of prices for goods and services is rising over a period of time. It also reduces the purchasing power. For instance, the price of a product is Rs. 100 in the year 2010 and it increases to Rs. 107 in the 2011. Then the inflation rate is said to be 7 percent due to the price increase. It also impact of an individual's financial life. If the Inflation rate increased, then the bank interest rates are also higher and due to this, the earnings of a company will be low. The reduction in inflation will be a good one, as the company and individual can get loans at a cheaper rate. This will support the economic growth of a country.

In India, there are three indices of inflation,

- Wholesale Price Index (WPI)

- Consumer Price Index (CPI)

- GDP Deflator

The WPI and CPI are calculated by the actual price and the GDP deflator is taken as the difference of nominal and real GDP growth rates. The Consumer price index is a retail index, which is calculated on a monthly basis with a basket representing retail household consumption. On the other hand, the wholesale price index is calculated on a monthly basis, using the wholesale prices of a basket of 676 item goods.

The GDP Deflator is the comprehensive national income deflator, the data taken from and published by the CSO. The Demand and supply also play a significant role for the Inflation.

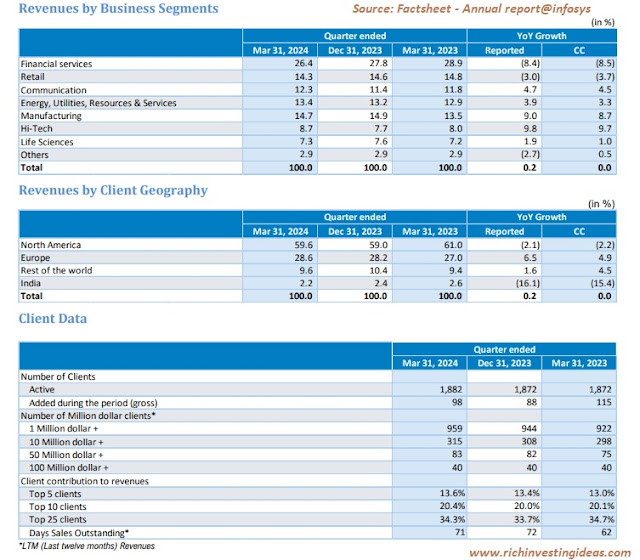

India - Retail Inflation rate (CPI - Historical):

Current Account Deficit:

It is the difference between the total exports and total imports of goods and services. The difference on exports and imports of goods is also referred to as Trade Balance. It is also linked as a percentage to the GDP. The current account deficit is also tells that the country is importing more than its exports. This could be managed in two ways like Foreign inflows and Capital inflows.

In India, the current account deficit depends on the exchange rate of the rupee and the oil prices. If the Import value is higher than the export, then it enables higher level of consumption, depreciation in exchange rate, consumers preferring to buy import products than domestic product.

In Simple terms,

Current Account Deficit (CAD) = Total Exports - Total Imports

The CAD is also known as Current Account Balance. A Negative CAD tells that the country is importing more goods than its export. Positive CAD will gives a healthy one for the economic growth, as the country is exporting more than its import of goods. So, they are earning more on Foreign currency by selling their goods to the rest of the world.

India - Current Account Deficit (Historical):

The other Macro economic policies are like Monetary policy action taken by the RBI, and the Government's financing, how the Government is spending the money for the economic growth and how it is borrowing for that. We can see these macro economic numbers, as the Government publishes in the Union Budget on this behalf.

Kindly share your views / comments with a smile :)

www.richinvestingideas.com

Comments

Post a Comment